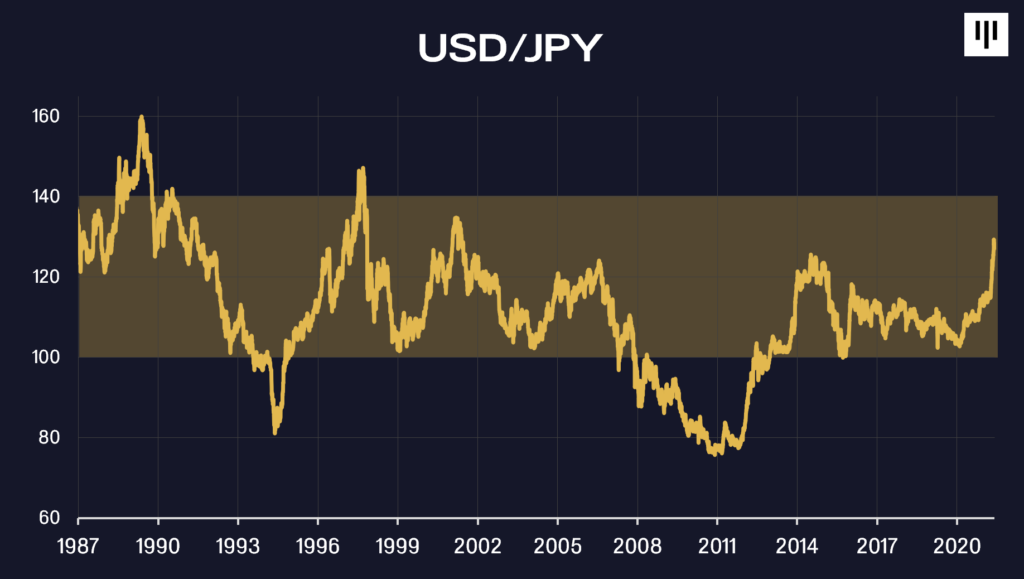

THE FIRST TRULY GLOBAL GLOBAL MACRO TRADE

Blockchain is the first truly global Global Macro trade.

I was laughing about Global Macro trading with my buddy Mike Novogratz. We’ve been trading USD/JPY for thirty-five years. We lived down the street from each other in Tokyo . . . we’ve studied it . . . agonized over it . . . bought, sold . . . sweated the drawdowns . . . but it hasn’t actually gone **anywhere**.

It’s literally exactly where it was the day we started in 1987 – 128.39. That’s insane.

In fact, it’s spent almost the entire time we’ve been sweating it in a range plus or minus twenty yen of 120. What was it all for?!?!

On the other hand, blockchain is going to change the world. Like the whole world; everybody with a smartphone will be using blockchain in a decade. That’s 3.5 billion people. We may never see the price of $38,342 /BTC again. Today might be the last time in history one can buy bitcoin that cheaply.

That’s why so many re-tread Macro traders like us love bitcoin/blockchain. It’s the same concept as we’ve worked on, but it’s actually going somewhere (massively higher) – and changing the world for the better.

Now there are even Global Macro angles to blockchain venture deals. For example, being long Circle equity is a great hedge against rising rates. Circle earns the float on the USDC stable coin. As rates rise their earnings go up. Nice counter-cyclical investment!

Another cool factoid: the DeFi protocol Celsius paid more interest to customers in 2021 than Bank of America.

![]()

INSTITUTIONAL TRANSITION PHASE

Institutional investors are in an uncomfortable moment. A few years ago it would have been massive career risk to propose investing in blockchain. A few years from now, it will be a huge fiduciary risk to NOT be invested. We’re in that uncomfortable interregnum period.

One observation I’d share from having had so many conversations with institutional investors is to not get obsessed trying to figure out which protocol will win. It’s not productive to stress about: “Which is going to win – Ethereum or Solana?” Sometimes investors want to spend the majority of a meeting trying to figure that out.

That’s not how you pick an equity manager. You don’t wait until the manager can explain which one company is going to take over the entire world. You select a great manager and let them buy a portfolio of stocks and trade into new things over time. The investment process should be the same in blockchain.

The beauty is you don’t have to decide between Ethereum and Solana. You are allowed to buy both – and Polkadot and Terra and 20-30 others which we own.

The logjam is breaking. Massive institutions are just now investing. We’re seeing it ourselves. We’re closing our Blockchain Fund next month at well over double our target with a large influx of new institutional investors.

It’s really hard to get from zero to one. It’s taken twelve years to get these institutions to invest. They are generally investing amounts like 20 basis points of their AUM into our fund. However, it’s not that hard to grow your exposure once you get over the zero to one chasm. In my mind, it’s very clear that all those institutions – which have something like 0.20% invested in blockchain – are going to something like 8.0% over the next 5-10 years. That wall of money is coming into blockchain assets. It will drive prices way up.

We’ve raised $2bn since the beginning of 2021. Our peers have raised similar amounts. That money will get invested. It might take a year or two, but it will get invested.

In the next couple of years, we and our peers will probably be seeing those institutions investing an order of magnitude more money into our space. It seems almost inevitable that the blockchain market melts up.

This moment in time is also uncomfortable because traders still think blockchain is supposed to trade in correlation to most other risk assets. I think the markets will soon realize that blockchain is totally different – there are no cash flows to discount. Rising rates have no impact on crypto. Crypto is priced on supply and demand. Every two years 10x as many people use crypto. If there’s a fixed quantity of something and 10x as many people want to own it, it goes up.

In a world where most risk assets have terrible performance, investors will seek out the few – like blockchain – that can perform well.

I think that blockchain prices will soon decouple from other risk assets. I can imagine a world with bond yields above 5.0%, stocks are down from today’s level, real estate is down, and blockchain is up 10x.

![]()

PANTERA SELECT FUND

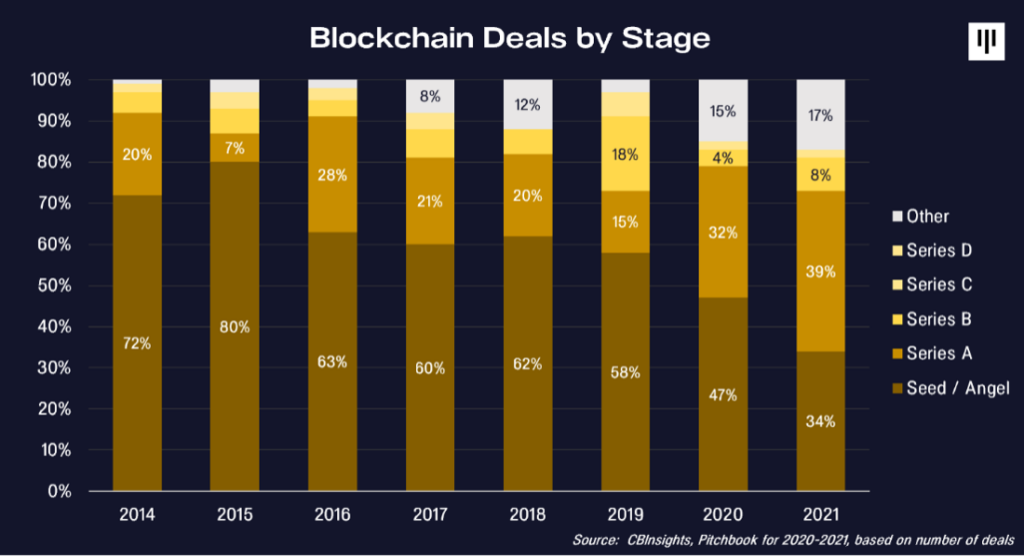

The market for blockchain deals is maturing as the industry has broadened to over $2 trillion in value.

When we began investing, Seed and Series A rounds were the only deals that existed. No company was old enough yet to raise a Series B. However, the industry has grown up. 27% of the deals now are past Series A.

Many of our portfolio companies are now valued in the tens of billions. We’ve spent almost a decade helping companies like Ripple, Circle, Alchemy, Starkware, Coinbase, Amber, and FTX. For example, we’re the only venture firm to have invested in every round Alchemy has done.

We are excited to be able to continue to meaningfully back the best companies. We’re launching a new fund which will be entirely growth-stage investments. Pantera Select Fund seeks to capitalize on the industry’s transition to more growth-stage opportunities.

We have a record pipeline of deals – including many portfolio companies raising growth rounds. Historically we’ve offered these opportunities to the Co-Investment Class of our venture vehicles.

For the first time in our nine years, we have three very compelling growth-stage deals locked in all at the same time. That motivated us to offer a special fund to help investors gain exposure to these growth-stage deals plus seven to nine more we will invest in over the next year.

The Fund expects to initially invest in three companies:

- Amber: A leading cryptocurrency financial services provider for individual and institutional investors, serving as a digital asset gateway with institutional-grade tools and investment products.

- CoinDCX: One of India’s largest and safest cryptocurrency exchanges, known for its top-notch cryptocurrency financial services. It provides a user-friendly experience in securely accessing different digital assets, and insurance and safety to its users.

- [Company name confidential]: The #1 provider of NFT domains on the blockchain; onboarding the world onto the decentralized web by building blockchain-based domain names which allow users to replace cryptocurrency addresses with human-readable names, host decentralized websites, and simplify crypto payments.

The structure of this opportunity is a concentrated fund: Pantera Select Fund. We are targeting $200mm. We plan to have the first, and possibly last, closing in May.

We will primarily focus on more mature, revenue-generating companies than our typical Seed and Series A venture investments. Here’s what to expect:

Please find the deck here. The recording of our first Select Fund Launch Call can be accessed here.

If you are interested in exploring this opportunity further, please reach out to our Capital Formation team at invest@panteracapital.com.

Pantera will donate 1% of revenue from Pantera Select Fund to 1% For The Planet.

PANTERA BLOCKCHAIN FUND FINAL CLOSING

Pantera Blockchain Fund, our “all-in-one” wrapper for the entire spectrum of blockchain assets, will close to new investors after the end of May.

The Fund has invested in 58 early-stage token projects and venture equity deals. We have a record pipeline behind that. Pantera participated in the $200mm Series B+ round for Amber Group – a crypto financial services provider that offers a suite of institutional-grade trading tools for both individuals and institutions. In addition to a handful of DeFi investments, we co-led the $135mm Series D for CoinDCX – a leading cryptocurrency exchange based in India. The Fund has also been investing in projects within the blockchain gaming, metaverse, and NFT sectors. Pantera has led or co-led 30 deals, with more to be announced in the coming months.

The summary of terms can be found here. Click the button below to begin the investment process online.

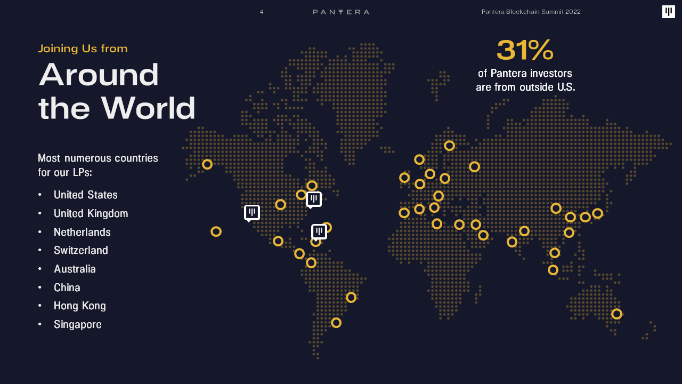

PANTERA BLOCKCHAIN SUMMIT

The momentum coming out of Pantera Blockchain Summit is wonderful. It reflects the remarkable engagement with our community of investors, entrepreneurs, and passionate enthusiasts. Seeing everyone in-person again was incredibly fun.

This quote captures the spirit of blockchain:

“The trope of the starving artist is over.”

– Dannie Chu, Co-Founder of MakersPlace

So many artists like Van Gogh lived, worked, and died unknown and broke. The centralized power brokers did not allow them access to the public who would ultimately love their work. The artists sold some works in their lifetime, got nothing from the subsequent massive appreciation in value. Blockchain changes all that. Creators can access their fans without waiting for the blessing of centralized power brokers. Not only do they not need to pay the incredibly high commissions on the original sale of their works, they can now receive a cut of the appreciation in their art each time their work is sold.

Decentralization is devolving power from the historical centers and restoring it directly to the people. Blockchain is the ultimate democratization – anyone with a smartphone can participate.

Our focus continues to be identifying and supporting the best entrepreneurs, providing them the value they need to succeed. We are very proud of the platform we have built thus far and are excited to expand those capabilities in the coming months, at scale.

We have uploaded video recordings of the Summit to our website here. Below we’ve provided some highlights from the day.

| Opening Keynote

An overview of the firm and our upcoming initiatives and our current outlook on the industry. Pantera Co-CIO Joey Krug also provides his assessment of the cryptocurrency market and where things are heading in the upcoming years. |

|

Fireside Chat with Bill Miller

Bill Miller is the Founder, CIO, and Chairman of Miller Value Partners. He is regarded as one of the leading investors of this era. Bill discusses how bitcoin is a “responsible” portfolio diversifier for institutional investors and how he approaches investing within the current macroeconomic environment.

The Web3 Economy: NFT’s and Beyond

A discussion about the Web3 economy and the proliferation of new applications ranging from NFTs, decentralized web domains, online identity, the talent economy, and decentralized social media.

Scaling the Multi-Chain Future

A conversation with the leading minds and developers behind the largest blockchain protocols outside of Bitcoin and Ethereum. The group discusses how the future is a multi-chain universe and how to scale the ecosystem to support billions of users globally.

Fireside Chat with Sam Bankman-Fried

A conversation with the CEO of one of the fastest growing companies in the blockchain ecosystem. Sam discusses his journey into crypto, seeing a market fit, and building one of the largest crypto exchanges in the world.

Market Perspectives: Wall Street Meets Crypto

A discussion with former Wall Street participants about their transition from the world of traditional finance to decentralized finance and their perspectives on how digital assets can play a role in institutional portfolios.

Building the First $10B Web3 Company

The co-founders at Alchemy discuss their journey building the first $10bn Web3 company and reflect on their process of identifying the incredible opportunity within this ecosystem. Their mission is to provide developers with the fundamental building blocks they need to create the future of technology.

![]()

PANDEMIC POLICY RESPONSE TWO YEARS ON

It’s been two years since policymakers began attacking an invisible virus with printed money. Let’s update how that’s working.

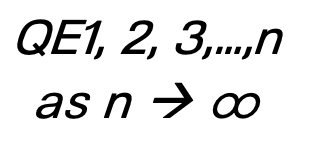

The opening of our post-pandemic April 2020 letter:

“This is a really distressing, massively confusing time. I have no idea what’s going to happen in 99% of things right now. However, I strongly believe it’s close to inevitable that this will be very positive for cryptocurrency prices.

“My kids used to count to 100, ‘One, two, skip a few, a hundred.’ It feels like we’re doing that on Quantitative Easing. QE1, QE2, skip a few, a hundred.

“As Quantitative Easing approaches infinity, it simply has to have an impact on things whose quantity can’t be eased.

“When governments increase the quantity of paper money, it takes more pieces of paper money to buy things that have fixed quantities, like stocks and real estate. They settle above where they would absent an increase in the amount of money.

“. . . Like hydrostatic pressure, that flood of new money will float all boats – inflating the price of other fixed-quantity assets like gold, bitcoin, and other cryptocurrencies.”

Since that prediction, the tsunami of paper money has floated all boats, especially crypto. Here’s a selection of fixed-quantity things since the paper money printing began:

Other tokens have even out-performed bitcoin.

![]()

THE COVID HANGOVER **IS** INFLATION

This paragraph in the newspaper raised my eyebrow:

“As they work to settle on a campaign strategy for November, Democrats said they need to better sell the public on what they see as Mr. Biden’s wins, chiefly pandemic stimulus and infrastructure spending, while making clear they will work to bring prices down. ‘We’ve done so much,’ said Rep. Mark Pocan (D., Wis.). ‘But the COVID hangover and inflation make it harder to talk about those really big things.’“

— Wall Street Journal, Democrats Search for Midterm Vote Strategy as Biden Poll Numbers Lag, April 12, 2022

I’m worried that policymakers still don’t get it that the COVID hangover and inflation are one and the same thing. There’s too much printed stimulus money chasing too few goods, chasing too few people willing to work, chasing too few homes for sale, etc. Policies enacted ostensibly to fight an invisible virus are creating a short squeeze in homes, labor, everything. THAT is the big thing.

![]()

THE LITTLE DIGGER THAT COULD?

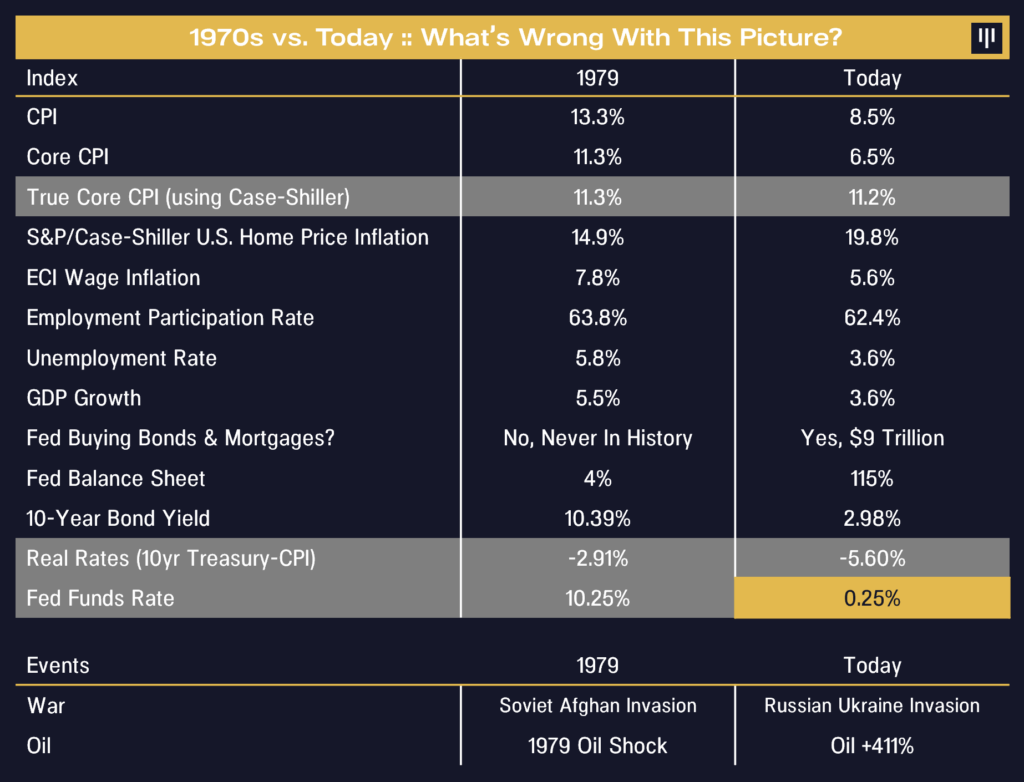

854 basis points of inflation and only 25 basis points of tightening? That’s obviously not going to work.

Fed Chair Powell acts like he’s really pulling out the big guns with, maybe, sometime in the future, increasing rates 50bps. Inflation is 17x higher. It should have been like 500bps six months ago to tame the housing bubble that the Fed directly created.

I met with an investor recently who said he wasn’t doing anything in normal markets, all he was doing is trying to buy as many homes as possible – and take out 30-year mortgages against them. I replied:

“Yeah, with the nationwide housing market running at 19.8% and the Fed still manipulating the mortgage rate down to 5.0%…the Fed is basically daring you to not to buy a house.”

If the Fed held no mortgages – as it did for their first 95 years – the free-market mortgage rate would be much, much higher. The Fed is directly creating this housing bubble.

In the coming years, the Fed will have to deal with the boom/bust stagflation consequences it is still inflating.

GDP just printed its first negative reading. U.S. gross domestic product fell at a 1.4% annual rate in the first quarter, the Commerce Department said Thursday.

![]()

IT’S CALLED THE 70’S

What’s wrong with this picture?

![]()

WHAT MOVIE IS THE FED WATCHING?

“I don’t want to be too rigid in how I think about the appropriate course of policy over the remainder of this year and into next year. . . By moving expeditiously towards a more neutral posture, it provides the committee with optionality in either direction.”

— Lael Brainard, Federal Reserve Vice Chair, April 12, 2022

It’s really astonishing. Moving very slowly to neutral when everything is out of control?!?!?

The Fed’s dual mandate is price stability and full employment.

Price stability to them means “only” debasing paper money by 2.0% per year. True core CPI (using more-realistic Case-Shiller housing prices) is in double-digits – five times the Fed’s target inflation rate. So, that mandate is obviously blown.

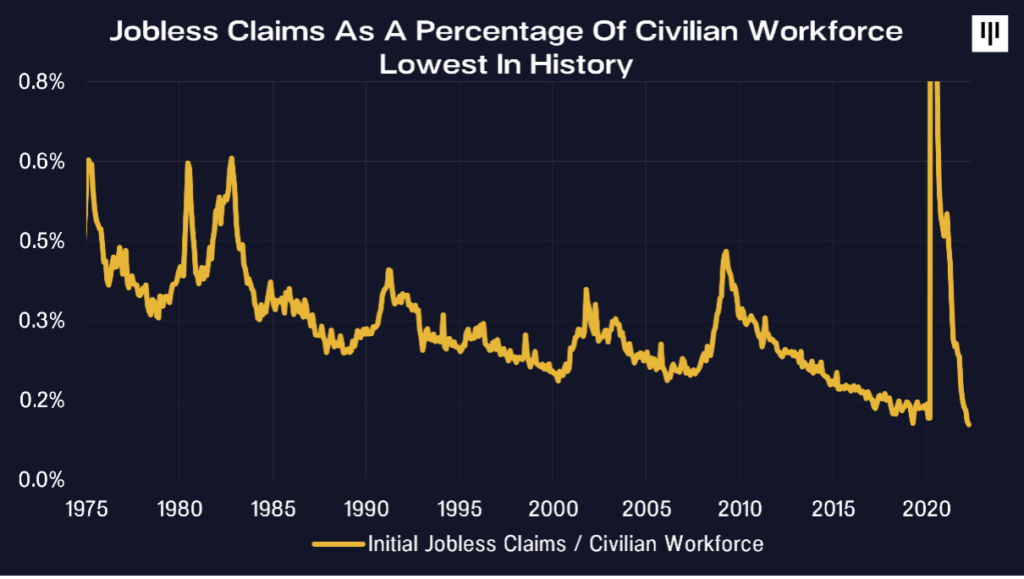

On the flip side, we are now clearly well past any optimal level of employment. There are fewer jobless claims as a percentage of the civilian workforce than at any time in the history of our country.

Only one out of a thousand people lost their job. Roughly similar to the odds of being hit by a falling coconut.

Even the Fed Chair admits that the labor short squeeze is unhealthy:

“If you take a look at today’s labor market, what you have is 1.7-plus job openings for every unemployed person. So that’s a very, very tight labor market, tight to an unhealthy level, I would say.”

— Fed Chair Powell, FOMC Meeting, March 16, 2022

There are 1.8 opening for each unemployed person. That’s never happened in history. The ratio is normally the other way around.

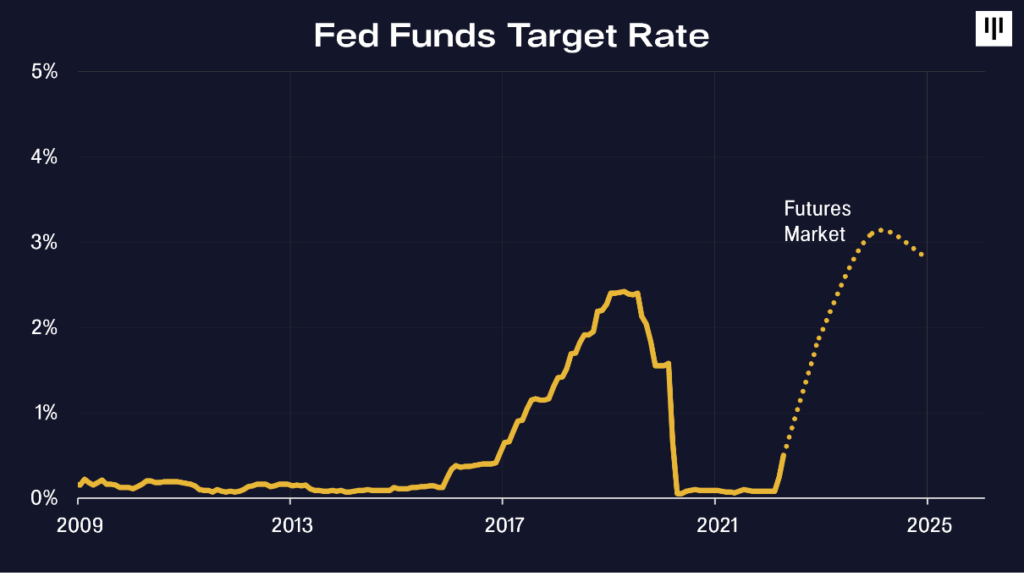

So, why this slow minuet to only neutral? Rates should be restrictive.

“The Fed is definitely behind the curve. Inflation is well above 2% both in PCE and CPI terms. The unemployment rate is at 4%, which is below the CBO’s estimate of full employment. In such an environment, interest rates should be a little above neutral, which is likely somewhere above 2%. We’re pretty far away from that point, so the Fed has a lot of room to catch up. If any mistake was made, it was not pivoting earlier.”

— Eric Rosengren, former President of the Federal Reserve Bank of Boston, March 14, 2022

Fed rates have been way too low for way too long. They’re going way higher than the futures market expects.

![]()

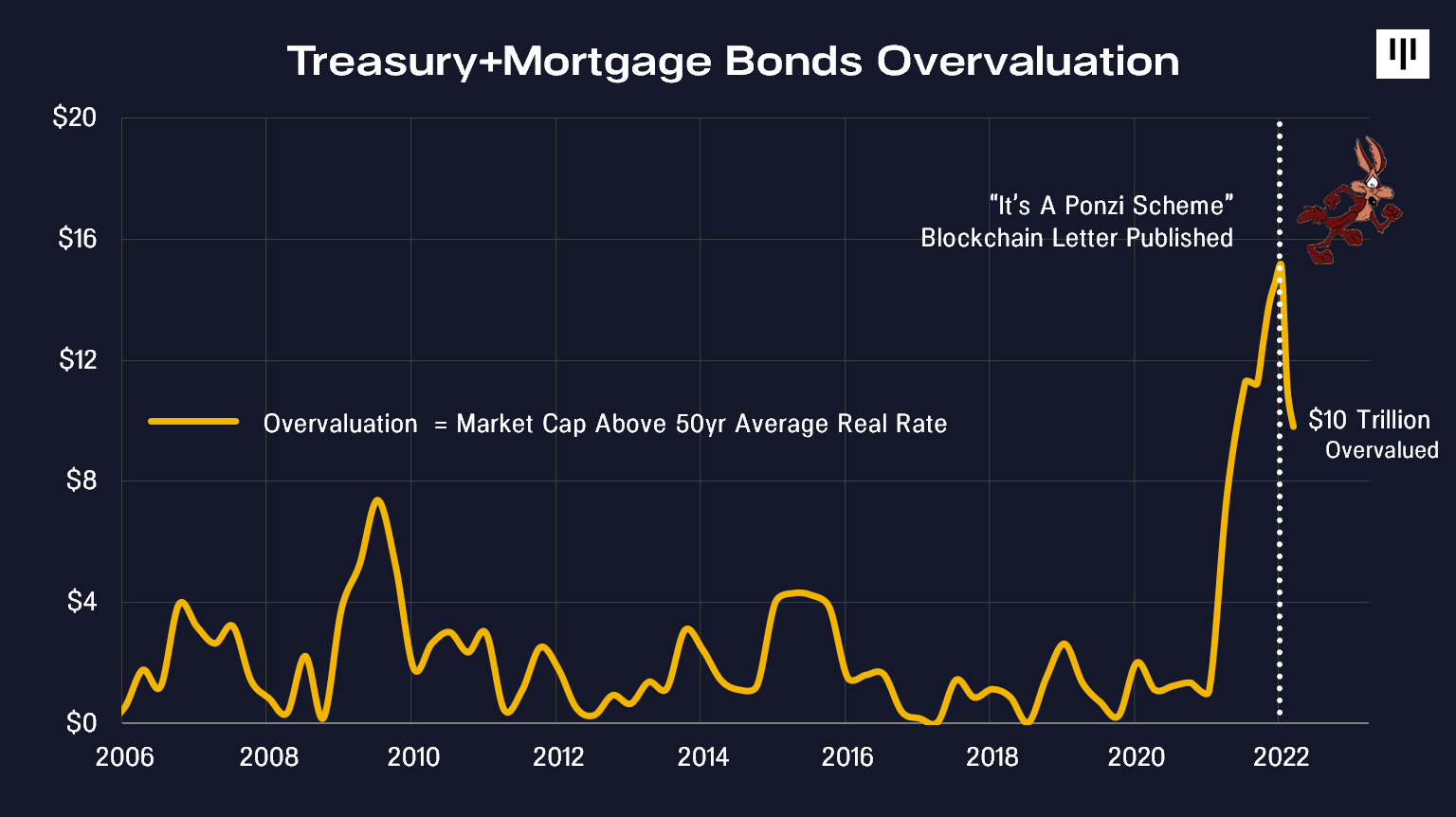

THE GREAT UNWIND

“Treasuries yielded 14% in October of 1981 when I got into this business. By 2020, rates got to the lowest in 5,000 years in all developed countries.

“Bonds beat stocks for over 35 years, which is sort of crazy, but, you know, there was a reason for it. Now it looks like finally with inflation, with geopolitical uncertainty, that bull market is over. Bond yields are rising rapidly at the 10-year rate, and I would expect that would continue.”

— Bill Miller, Founder of Miller Value Partners, Pantera Blockchain Summit, April 5, 2022

Since the 2008 Financial Crisis, the vast majority of sovereign debt has been purchased by price-insensitive government buyers. It is a combination of domestic central banks like the Fed monetizing their own debt and countries trying to keep current account surpluses offshore and thus hold down the value of their currencies by selling their currency and buying dollars (which need to be invested in treasuries).

QE created a rare investment world where both bonds and stocks rallied simultaneously. (In a free-market world, their prices are inversely correlated.)

Quantitative Tightening (QT) will have both bonds and stocks falling simultaneously.

It is also likely that adversarial regimes will reduce their USD currency reserves and liquidate US treasuries as a response to the recent seizure of Russia’s US dollar reserves resulting from the sanctions on public and private entities.

![]()

THE STAGFLATION MEGA-TRADE :: BANKLESS PODCAST HIGHLIGHTS

Ryan Sean Adams: “This is the highest inflation in 40 years, 8.5% CPI. Can you tell us what’s going on?”

Dan Morehead: “It’s 35 years since I’ve been doing this, so I’ve seen a lot of cycles, and this is the craziest one ever.

“The Federal Reserve pumped up a bubble in bonds that is just really off the charts. The bond market is what fuels the mortgage industry and a record number of Americans took out a mortgage last year and bought property. Not surprisingly, houses are up 19%. If you are a homeowner, that’s a good thing, but 35% of Americans do not, so I think that’s a terrible thing.

“The chairman of the Fed about a year ago said it was a transitory blip in inflation. This is not transitory, this is a massive, massive problem. Each month since Powell said it was transitory, it’s printed a new record high. We really are back to the craziest bit of the ’70s.

“The cost of Ubers has doubled and to me that’s such a great indication of the tightness in the labor market. Used cars now are higher priced than when they were brand new. That’s super crazy. It’s never happened in history. Basically everything is on fire and more expensive.”

David Hoffman: “How did we get a bubble in the bond market?”

“First is Congress essentially approving $9 trillion worth of spending.

“The U.S.’s deficits in the last two years have literally been bigger than any year in World War II. World War II we were fighting fascism. It was a big thing. Here the amount of money that’s been spent fighting this invisible virus is staggering and very inefficient. It’s literally been 50 grand per family in the United States. I mean, that is just an enormous amount of money. Of course, there were some policies that needed to happen and there were some people that really needed help. But most of the people that got stimulus checks saved them. The savings rate went up in a recession, again, something that has never happened in history.

“So nine trillion new pieces of paper dollars were printed and sent around to everybody. Again, a minority of them really needed the help and probably needed more help. But most of the people didn’t. So what’d they do with it? They bought stuff with it.

“They bought stocks. Stocks are at record highs. They bought gold, they bought bonds. So people invested all that free new printed money.

“If you print 9 trillion new pieces of paper money it takes more pieces of paper money to buy a 2021 car, or a median home in the United States, or a share of the S&P 500. It just really is that simple. The value of paper money is being debased.

“In 35 years of trading I’ve never seen something both so extreme and so massive. I’ve seen some weird trades in small little corners of the world, some emerging market where something weird is happening. But the Federal Reserve doing it nine trillion sized – I mean, this is the biggest bubble.”

David: “Can you kind of walk us through what you think happens next with all of this?”

“I think in about two months, the Fed is going to realize, ‘Hey, this thing’s really getting out of control.’ Instead of just waiting around for these bonds to slowly mature (which is going to take a long time, because the majority of their bonds are like 20 year maturity), they’re going to have to start selling bonds. When you go from the Fed buying billions and billions of bonds every month to now selling tens of billions, the bonds are going to get crushed.

“I said in our letter, it’s the first non-blockchain trade I’ve done in eight years because it’s so asymmetric. I think it’s like a 90% chance rates go way up.

“The punchline is, you probably don’t want to own a lot of treasuries.

“When I was growing up, there was the 60/40 normal asset allocation mix: 60% stocks, 40% bonds. I’m sure there are pension plans and insurance companies that have legacy portfolios that still have a decent amount of bonds, but if you’re looking at all the facts that we can see today as a normal free market investor, it just is so hard to say, ‘Hey, at 2.7% for the next 10 years, with inflation reported at 8.5% but really at like 10.7%, I’m going to buy a 2.7% 10-year note.’ I really can’t imagine how anyone would do that.

“I think the penny is dropping, but it’s dropping very slowly. There is no working-age American that has invested in a rising rate environment. That is so important to keep in our heads – I’m 56 and it was already six years into the bull market when I got to Wall Street – the 10-year note was at 10%, so it could easily be 5% or 10% again. But most people your age have literally never even come close to seeing a 10% 10-year note.

“Everything has been going up for 40 years because rates just keep going down and down and down. In July of last year, 10-year rates hit 54 basis points. That’s it. That was the end of the bull market. Rates certainly aren’t going any lower than that.

“I think we’re in a five-year bear market on bonds and we all have to get our head around that. I’m still trying to figure out what that means in our portfolios.”

David: “What do you make of how the crypto markets are digesting all of this macro news?”

“Basically, there’s almost nowhere to hide, right? That’s why we called it the ‘Great Unwind’, everything except crypto, I think, is really going to be impacted.

“If we’re even partly right, that bond yields are going to go to 5% or higher, that obviously crushes bond prices, but it also has to impact stocks and real estate and anything else that has a discounted cash flow.

“The reason I’m still convinced that blockchain can have a very low correlation with everything else is most people don’t own any of it, right? Most institutional investors really don’t own a material amount of cryptocurrency assets. Some of the biggest endowments maybe have one or two or 3% in blockchain. There’s a lot that still owns zero. Most major insurance companies basically own zero. And so that’s how they can stay uncorrelated, I think for the next, say, five years. If we’re right, and blockchain is a really important thing, and in time it becomes an asset class, I think everyone will have like 8% of their portfolio in blockchain. In 10 years blockchain will be as correlated with the S&P as anything else, commodities or bonds or whatever. But for now, I really think it can be uncorrelated.”

Ryan: “How would you describe an easy button portfolio for blockchain exposure here?”

“Unfortunately it’s not as easy as it used to be, really it’s the sad answer, if we wanted a quick answer.

“Obviously Bitcoin was everything for a long time and it was great. I used to tell people, ‘Buy some Bitcoin.’ And then for a long time, I was like, ‘Hey, buy half Bitcoin, half Ethereum and you’re going to be fine.’ The world’s way more complicated than that now.

“The kind of theoretical answer, and obviously not super pragmatic for all your listeners, is to be investing in a lot of different things. We probably are invested in 200 different things across all of our funds. The reality is there are going to be probably 10 or so really important layer one blockchains. All the others are actually just kind of companies basically built on top of other protocols.

“There is a great line that the chairman of the SEC said about five months ago that we don’t need 5,000 new private monies. I think he and lots of people misunderstand it. There aren’t 5,000 layer one blockchains, right? There just aren’t. There are 10 or so that are important. Almost all the rest of those are just protocol applications built on somebody else’s protocol. The US has 4,500 public companies, so I have no problem with 4,500 tokens, right. We’re not there yet. There aren’t 4,500 real tokens yet, but in 10 years there will be.

“The punchline of all that is a portfolio should be many things, more than just one or two things. The theoretical answer is to invest in a broad portfolio of things, because there are a lot of things going on. For example, last year, Bitcoin was up 70% and our Liquid Token Fund was up 325%. There are a lot of things going on, one of which is Bitcoin, but there are 30 other important things on the liquid side. There’s 80 or so in the private token side of our portfolio. So, for those that can invest in a fund manager, like ourselves (there are a bunch of great managers in the space), is probably now better than the old days, when I’d say, ‘Hey, just buy some Bitcoin and Ethereum, you’re probably fine.’ These days, I think you do need a broader exposure.”

Check out the recording here.

![]()

MORTGAGE INFLATION = 38%

A year ago, the cost of paying the mortgage on the median U.S. home was $1,223 (the monthly payment after a 20% down payment), according to calculations by George Ratiu, an economist at Realtor.com.

Today, such a purchase would require a monthly payment of nearly $1,700 — a 38% increase.

![]()

THE DISCOVERER OF PANTERA, THE BAND

I was having lunch at an outdoor restaurant and a nice guy named Mark Ross came up to introduce himself. Said he was an LP in our fund and asked how I named the firm. I replied that I didn’t, my wife Devon did. I then pitched his request over to her. Devon did the bit about “having been at Tiger Management where all the funds were named after big cats, “pantera” is Spanish and Italian for panther and that Pantera was originally a global macro fund, “pan terra” is Latin for “spanning the earth”…oh, and it was a metal band in the 80’s.”

That’s why he asked – Mark was the A&R man at Atlantic Records who discovered and signed the band Pantera. That’s epic! LP Hall of Fame.

https://loudwire.com/pantera-cowboys-from-hell-album-anniversary/

![]()

All the best,

@Dan_Pantera

“Put the alternative back in Alts”

CONFERENCE CALLS

Our investment team hosts monthly conference calls to help educate the community on blockchain. The team discusses important developments that are happening within the industry, and will often invite founders and CEOs of leading blockchain companies to participate in panel discussions. Below is a list of upcoming calls for which you can register via this link.

Pantera Early-Stage Token Fund Ltd Investor Call

Tuesday, May 3, 2022 7:00am PDT / 16:00 CEST / 10:00am China Standard Time

Open only to Limited Partners of the fund.

Pantera Early-Stage Token Fund Investor Call

Tuesday, May 3, 2022 9:00am PDT / 18:00 CEST / 12:00am China Standard Time

Open only to Limited Partners of the fund.

Pantera Liquid Token Fund Investor Call

Tuesday, May 10, 2022 9:00am PDT / 18:00 CEST / 12:00am China Standard Time

Open only to Limited Partners of the fund.

Pantera Select Fund Launch Call

A detailed dive into our new growth-stage fund.

Tuesday, May 17, 2022 9:00am PDT / 18:00 CEST / 12:00am China Standard Time

Please register in advance via this link:

https://panteracapital.com/future-conference-calls/

Pantera Blockchain Fund Investor Call

Tuesday, May 24, 2022 9:00am PDT / 18:00 CEST / 12:00am China Standard Time

Open only to Limited Partners of the fund.

Investing in Blockchain Conference Call

A discussion of the blockchain opportunity set and how Pantera’s four funds are structured to capture value in this rapidly evolving ecosystem.

Tuesday, May 31, 2022 9:00am PDT / 18:00 CEST / 12:00am China Standard Time

Please register in advance via this link:

https://panteracapital.com/future-conference-calls/

Pantera Select Fund Launch Call

A detailed dive into our new growth-stage fund.

Tuesday, June 7, 2022 9:00am PDT / 18:00 CEST / 12:00am China Standard Time

Please register in advance via this link:

https://panteracapital.com/future-conference-calls/

Recordings of past conference calls are available on this page.

PORTFOLIO COMPANY UPDATES

Ondo Raises $20 Million Series A to Build a Decentralized Investment Bank

Ondo Finance is a platform that provides structured products and other customized financial products for retail and institutional investors. Ondo is building a decentralized investment bank to accelerate the adoption of DeFi by connecting DAOs, institutions, and retail investors. Pantera co-led the $20 million Series A round with Founders Fund, and previously led Ondo’s $4 million seed round in August 2021.

CoinDCX Raises $135 Million Series D at $2.15 Billion Valuation

CoinDCX is an Indian cryptocurrency exchange platform and the first Indian crypto firm to achieve unicorn status. They have grown to over 10 million users and doubled its valuation in the last 8 months. CoinDCX is looking to expand its product offerings, talent base, and compliance efforts with this new raise. Pantera co-led the $135 million Series D round alongside Steadview, with participation from Coinbase Ventures and Republic Capital.

Wyre Acquired by Bolt for $1.5 Billion

Wyre is a fiat-to-crypto payment infrastructure platform for the crypto ecosystem. Bolt, a checkout and shopper network company, announced their agreement to acquire Wyre for $1.5 billion in the largest crypto acquisition to date. Bolt and Wyre will offer cryptocurrency commerce solutions for millions of consumers and retailers. Pantera previously led Wyre’s $8 million Series A round in December 2018.

0x Labs Raises $70 Million Series B to Expand Core Infrastructure

0x is an open-source, decentralized exchange infrastructure that enables the exchange of tokenized assets on multiple blockchains. 0x has enabled the transfer of over $158 billion in tokenized value across 43 million trades. The funding round will help expand new product offerings such as Matcha and 0x API. Pantera participated in 0x Lab’s $70 million Series B round led by Greylock. Pantera previously led their $15 million Series A round in February 2021.

Circle Raises $400 Million to Drive Strategic Growth

Circle is a global internet finance firm and issuer of USDC. The $400 million funding round comes from BlackRock, Inc., Fidelity Management and Research, Marshall Wace LLP, and Fin Capital and will contribute to growth initiatives as the demand for USDC and related financial services rises. BlackRock will also act as a strategic partner for Circle, exploring capital market applications for USDC. Pantera previously participated in Circle’s $17 million Series B round in March 2014.

Investing in Decentralized Wallets and Lending Protocols

Leap Wallet is a non-custodial wallet for the Terra ecosystem that allows users to interact directly with decentralized applications and NFTs. Leap plans to bring on new talent to its engineering, design, product, and marketing teams. Pantera co-led the $3.2 million private sale alongside CoinFund.

Hedge is an interest-free lending protocol for Solana. They aim to help users unlock more liquidity for their assets with their USH dollar-pegged stablecoin. Hedge will expand its team and launch its liquidity vaults this quarter. Pantera participated in the $3.7 million seed round led by Race Capital.

Nova Labs Raises $200 Million Series D to Expand Helium Ecosystem

Nova Labs (previously Helium) created the Helium network which allows users to share their home internet service and earn rewards for supporting the network. The network grew from 14,000 active nodes to over 500,000 in 2021, and has more than 680,000 nodes running today. Nova Labs will invest in the ecosystem through hiring and adding development resources as well as building new applications on the Helium network. Pantera participated in the $200 million Series D round led by Tiger Global and a16z.

PANTERA OPEN POSITIONS

Pantera is actively hiring for the following roles:

- Execution Trader

- Associate, Capital Formation

- Associate, Capital Formation / Office of the CEO

- Co-Head, Capital Formation

- Director, Capital Formation

- Platform Engineer

- Trading & Middle Office Python Developer

- Executive Assistant to the Investment Team

- Executive Assistant/Office Manager

- Executive/Personal Assistant to the CEO

- Associate, Accounting

- Associate, Finance & Operations

- Senior Associate, Accounting

- Tax Manager

- Growth Stage Investment Associate

- Investment Associate/Analyst

- Platform Associate / Analyst

- Security + Cryptoeconomics Auditor

- Associate, Investor Relations

- President

- Director, Co-Investment & Opportunities Program

- Senior Associate, Co-Investment & Opportunities Program

- Content Writer

- Events Manager

If you have a passion for blockchain and want to work in New York City, San Francisco, Menlo Park, San Juan, or London, please follow this link to apply. Some positions can be done remotely.